With its decades old strong and robust industry “Terrorism”, Can Pakistan survive without Loans and Foreign Aid? Pakistan is a Failed Nation. Does going to the multilateral agencies like IMF, World Bank, ADB and demanding for loans, signing dotted line, not equivalent to begging for money? Pakistan is a “Terrorist Producing Factory” of the world. Can the whole world let Pakistan spread its Terrorists, Radical Islamist, Grooming Gangs worldwide without impunity?

Pakistan Prime Minister Imran Khan recently during his US visit said, “I would like to have a relationship between the two countries of mutual trust. I would like to have a relationship as equals of friendship. Not as it has been before […] Pakistan wanting aid from the US and then for aid it is expected to do certain things […]I hate the idea of asking for funds. Aid has been one of the biggest curses for my country. What it has done is it has created the dependency syndrome […]. Countries rise because of self-respect and self-esteem. No country rises because of begging and borrowing for money.”

These words the Pakistani Prime Minister Imran Khan uttered in United States Institute of Peace, during his US visit, are exactly what Pakistan isn’t. Or may be, they are a case of sour grapes – did he realize that Pakistan is not going to get aid from America?

One of the Ministers in Pakistan Prime Minister Imran Khan Cabinet, in a Press Conference in Pakistan accepted that all the previous visits by all Pakistan Prime Ministers in the Past were for Begging Money to all the Countries. Since they did not get any Alms during this visit, they started singing “Grapes are Sour” saga.

Pre-Election Promises and Post-Election Reality

Imran Khan came to power promising to build a Pakistan which isn’t what it was before predecessors did – aid, debts and unpaid loans. In fact, he made his supporters make a public pledge “Kisise Kabhi Bheek Nahi Maangenge” (We will not beg from anyone) but as the situation turned out, he had to do exactly what he promised to eradicate. His dream to make Pakistan survive without loans went in thin air.

Before the elections, Imran Khan promised to work rapidly to recover the proceeds of Pakistani corruption, estimated to be worth tens of billions of dollars, invested in offshore assets. He claimed he would be able to mobilize investments from the 10-million-strong Pakistani diaspora in the Persian Gulf, Europe and North America. He expressed such distaste for “begging” from multinational institutions that he described it as worse than committing suicide.

However, after coming to power, his promises seem like pre-election promises that are meant only to get votes and not to be worked upon. Recently social media was flooded with pictures of DG ISPR Asif Gafoor and his son living luxurious life in London.

Due to the misgovernance of Imran Khan, the demands of the army, a belligerent India which was at the receiving end of Pakistani terror and the collapse of Pakistani economy which timed with the rise of Imran Khan means that Pakistan was forced to survive only on foreign aid. At least three times, Pakistan avoided sovereign default because of Foreign loan (the Chinese have given around $4 billion, the Saudis $3 billion and the UAE $ 2 billion).

Foreign Aid to Pakistan from UK and EU

Pakistan has got Billions of Pounds in Aid from UK, Millions of Euros from EU under various projects. Shouldn’t UK and EU stop giving these “alms” to Pakistan? After all, who can forget the Rotherham Grooming Gangs (Read our article Pakistani Muslim Grooming Gangs In UK Raped Thousands Of Girls 8-12 Year Old) or the Pakistani links in the notorious London Bombings of 2015? Or Pakistanis entering Europe as a part of Arab Spring immigrations and creating Law and Order issues? Even Imran Khan’s admission of 40,000 terrorists operating from Pakistan hints at the state sponsorship of terror and as a byproduct, spending a part of the aid on global terror. This is in spite of the fact that Pakistani economy is collapsing due to bad management and related issues.

23rd IMF Bailout

On the economic front, with a steady deterioration of Pakistani position, the country was forced to go for a record 23rd bailout from IMF. IMF attitude was predictable – it asserted on terror links, less spending on defense and impossible structural changes.

The desperation in Pakistan over IMF loan can be clearly seen from fact that it actually accepted the high-level structural changes which IMF demanded.

- Asad Umar is sacked as Finance Minister and replaced by Hafeez Sheikh, whom Imran Khan, the Prime Minister of Pakistan never met in his life till then.

- IMF’s resident director for Egypt Dr Reza Baqir is appointed as Chairman of State Bank of Pakistan, effectively turning State Bank of Pakistan as a branch for IMF.

- Shabbar Zaidi, a chartered accountant was removed from ECL an appointed as Chairman of FBR.

Asad Umar echoed the same before he was sacked – “We will have to take a loan to support the falling economy.” The minister said that Pakistan will have to make tough decisions to fix the economy.

Special Assistant to the Prime Minister for information and Broadcasting, Dr Firdaus Aashiq Awan unwittingly admitted that every of Imran Khan’s foreign visit till his American trip was aimed at alms (she used the words alms and not aid), further spelling out the desperation in the country’s financial situation.

This single statement by Dr. Firdaus is multifaceted. It talks of Pakistan’s stature in the world, it talks of Imran Khan’s stature inside Pakistan and it tells of desperation inside Pakistan.

Finally, the free lunches are over and Pakistanis will have to start paying their own bills. Far from being a bailout, the IMF program is going to force extremely difficult and unpalatable reforms on Pakistan and confront it with the choice of “Perform or Perish”. The IMF agreement is therefore virtually Pakistan signing on the dotted line. Besides, given Pakistan’s IMF quota and the loans previously contracted – nearly half of the current package will go in repayment of previous IMF loans.

Given that in the next fiscal, Pakistan is expected to face a financing gap of anything between $10-11 billion annually and has to pay back over $30 billion over the next 7 years, the IMF tranches are not going to be enough.

According to reports in the Pakistani press, the government will have to collect anything between 30-35% more revenue. This means around Rs 1.5 trillion over the 2018-19 revenue collection of Rs 3.95 trillion. At a time when growth is expected to fall under 3% and inflation expected to rise to double digits, raising revenue by a third through increasing tax rates, eliminating tax exemptions and concessions (including to exporters) and subsidies, and cutting government expenditure is going to be a mission impossible. The provinces are not exempt – funds will be cut to the provinces and that is going to have its own repercussions on the federal polity.

Recently we exposed Pakistan Intelligence agency for organizing the Shutters-down strike in different parts of Pakistan to fool IMF and get exceptions in the conditions imposed by IMF for the $6 Billion Bailout Loan. It is covered in detail in our previous article “Pakistan ISI Behind Yesterday’s Countrywide Shutters-Down Strike. Fooling IMF.”

Explaining the confidence in Pakistan on receiving loans, Dr Adeel Malik, a development macro economist at Oxford University, said Pakistan was aware “an IMF program would be readily available as long as they have given a geopolitical concession behind the scenes”.

“If we assume the IMF, motivated by intensifying US pressure, will be tightening the whip this time round, then Pakistan will have a major problem on its hands,” said Michael Kugelman, deputy director of the Asia program at The Wilson Center, a Washington-based think tank.

“And that’s because Islamabad may be willing to take some tough steps, but it’s not going to betray entrenched, long-standing interests that require it to alter its relations with anti-Afghanistan and anti-India militant actors.”

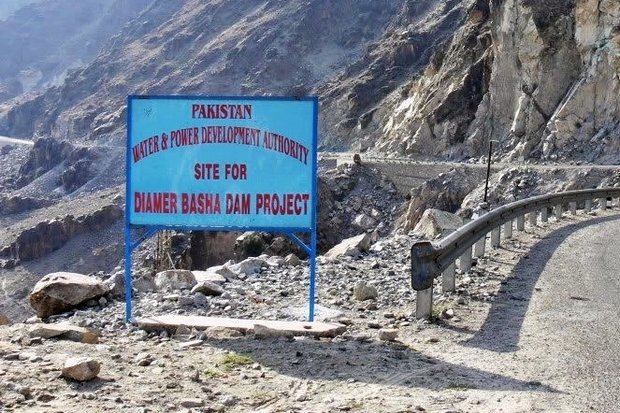

CPEC remained a Wet Dream

It is understood that even the much touted CPEC is not able to provide a cushion to this free fall of an economy. Though it’s a drain on the economy with Pakistan receiving almost 9 billion USD as loan after Imran Khan became the Prime Minister, it still had a potential to be a game changer. But, not anymore.

Though Pakistan never had an economic potential to support the massive investments in the name of CPEC, Indian escalation, leading to lower factory output and power consumption, made it completely unviable. The first power project of CPEC – PQEPC has already declared losses and it’s a matter of time China may give up on CPEC.

Vicious Circle of Circular Debt

PQEPC, on one side highlighted flagging business and stuck resources due to circular debt and on the other side, it is facing issues due to Pakistani Government’s inability to pay the arrears which has already crossed $150 million(21 Billion PKR). Rupee depreciation is another massive issue to the companies because they can’t transfer the losses to Pakistani Government. Pakistani Rupee has already depreciated by 52% to PKR 160.75 to the US dollar since December 2017.

As per Sheng Yuming, who is the chairman of Power China Resources Limited – the parent company of PQEPC, “We are trying our best to generate more power and get more tariff payment timely as you know that this is a power plant, we have to import coal from the international market, also we have to repay debt to the financing banks…Coal comes to around 80-85% of the total cost of power production at the plant. The rupee depreciation has wiped out our possible (net) profit in the first year of operations.”

Circular debt is another massive issue inside Pakistan. According to Sheng Yuming, “working capital is stuck in circular debt and it faces notable losses on the import of coal fuel in the wake of massive rupee depreciation.”

Pakistan’s circular debt stood at around Rs603 billion as of late March 2019. As another marker for the bleak economic scenario, External Debt in Pakistan increased to 105841 USD Million in the first quarter of 2019 from 99086 USD Million in the fourth quarter of 2018. External Debt in Pakistan averaged 57057.47 USD Million from 2002 until 2019, reaching an all-time high of 105841 USD Million in the first quarter of 2019 and a record low of 33172 USD Million in the third quarter of 2004, with China being one of the main contributors.

In 2017 as, higher oil prices and the boom in growth — along with billions of dollars in Chinese infrastructure investment — pushed up demand for imports, the current-account gap started to widen, and reserves fell, triggering a 20% slump in the nation’s currency last year and pushing the benchmark KSE-100 Index of stocks to around three-year lows.

It is worthwhile to note, there are rumors that China has already demanded Gilgit and Gwadar on a fifty-year lease in return for the money China is investing in Pakistan. The illegal Baloch gold mine found should also be looked from this angle – the inability of Pakistan to pay back the Chinese loans. It is understood that only after Imran Khan came to power, Pakistan took a loan of $9 Billion from China.

The distress has slowly crept into the domestic market with almost every sector in the country – traders, government and private employees – even of MNCs, doctors and everyone protesting either over insufficient or unpaid salaries.

The same is visible in PSX whose continuous slide in the past few months, especially post Pulwama can indicate only one thing – flight of capital and the CEO of PSX, Richard Morin was forced to resign.

The sliding rupee and increase in taxes and prices to shore up government revenues means less demand for Pakistani produce overseas due to increased prices and shutting down of factories. For instance, 200 textile mills are closed on 01 July 2019.

APTMA Sindh-Balochistan Region Chairman Zahid Mazhar had said that an increase in gas tariff by 31 percent was the last nail in the coffin of the general industry and the textile industry in particular. “Around 75 to 80 mills are on the verge of closure, which will add to the unemployment figures by another 0.5 million workers employed in the textile industry,” he added further.

Impact of India’s Policy Changes viz Pakistan

Indian policy changes for bilateral trade post Pulwama also added to the woes – multiple sectors where there is massive dependence on Indian raw material like textile and pharma and where a bulk of exports are sent to India like cement and dry dates are facing trying times.

Government of India withdrew MFN (Most Favored Nation) status from Pakistan and imposed 200% import duty on all products imported from Pakistan. As per sources, “it was a nail in Pakistan’s coffin.” Since February 16, around 90,000 bags of cement, 6,000 bags of dry dates, 500 tonnes of limestone, gypsum and inorganic chemicals and drugs in bulk have been lying at the Attari Integrated Check Post (ICP) for the want of Customs clearance. Due to stopping of the cross-border trade, the prices of essential commodities including the vegetables that Pakistan was importing from its neighbor India, sky rocketed.

Also, the interest rate has gone from around 6% to over 11%, another 2% rise will take it to over 13%. The lending rate will go up commensurately to around 15-16%, which will make the cost of doing business very high.

Impact of Afghanistan Military Tough Actions against Taliban Terrorists on Pakistan Economy

Another reason for Pakistan downfall is attributed to its policy of funding and arming Taliban Terrorists to wrest power in Afghanistan. With Afghanistan Government taking control of the illegal mines, Millions of Dollars’ worth of marble, Nephrite and other previous stone that were smuggled to Pakistan by Taliban have been reduced. We covered it in detail in our previous article Army Plunges Taliban Revenue Sources In Afghanistan. Frees Nephrite Mine From Taliban

USP – Unique Sales Proposition of Pakistan

With such a gloomy picture and an unconcerned government, Pakistan has perfected the art of living off foreign aid and loans. Over the last seven decades, Pakistan’s elite have become so used to other peoples’ paying their bills that there is now almost a sense on entitlement that every time they are on the brink of bankruptcy and about to default, the world will come to their rescue and bail them out. After all, Pakistan’s Unique Sales Proposition (USP) – a nuclear weapons state in which Islamism and jihadism is not just an article of faith but also a foreign policy instrument – has made it ‘a country too dangerous to fail’.

Dreading the prospect of a failed Pakistan, the West and in particular the US, has always thrown a lifeline whenever Pakistan started to sink. But instead of crisis providing an impetus for reform and improve the living standards of its 210 million people, the bailouts given to Pakistan have only emboldened, encouraged, even incentivized, it to treat debt as disposable income, and when payback time comes, seek more handouts.

And this is something Pakistan is not able to understand.

Pakistan has also been watchlisted by the Financial Action Task Force, a multilateral anti-money laundering body, for failing to shut down anti-India militant groups whose leaders continue to hobnob with cabinet ministers.

Fiddling over Iran issue is also aimed at the same direction.

ADB has understood this free lunch business and distanced itself from the “premature announcement” of Prime Minister Imran Khan’s adviser that the global lender would provide a loan of USD 3.4 billion to the cash-strapped nation, saying “discussions are ongoing” hugely embarrassing the government.

Imran Khan’s adviser on finance Abdul Hafeez Shaikh and Federal Minister for Planning, Development and Reforms Khusro Bakhtiar peddled a Lie that the country would get a loan of USD 3.4 billion for budgetary support, out of which USD 2.1 billion would be released within a year.

That the Asian Development Bank (ADB’s) stance taking the rare step on a public holiday to issue a statement tells how much it is interested in distancing itself from Pakistan.

So, what’s the main reason for this poor health of Pakistani economy?

In her 2007 book Military Inc: Inside Pakistan’s Military Economy Dr Ayesha Siddiqa exposes the rampant commercialism pervading every aspect of the country’s military forces. Dr Siddiqa, a former researcher with the country’s naval forces, found that the army owns 12 per cent of the country’s land, its holdings being mostly fertile soil in the eastern Punjab. Two thirds of that land is in the hands of senior current and former officials, mostly brigadiers, major-generals and generals. The most senior 100 military officials are estimated to be worth, at the very least, £3.5 billion.

In 2016, the Pakistan senate was informed that the army’s commercial wings, including the Fauji (Army) Foundation, the Shaheen Founation, the Bahria Foundation, the Army Welfare Trust and the Defense Housing Authorities, owned as many as 50 business concerns and housing property worth over $20 Billion. However, three years later, the number of ventures owned by the army is in hundreds with net investment reportedly exceeding $100 Billion. In order to avoid the wrath of the all-powerful Pakistan Army, Imran khan turned a blind eye to the Pakistan Army.

With no hint of thawing relations with America over aid release, other countries slowly in a mood to back out due to mounting arrears, it needs to be seen how long Pakistan can survive with a broken economy only on loans.

Even then, nothing is unredeemable if there is intent. The whole of Pakistan knows cutting down Defense allocation is the only option available to fix it. But, will Pakistan take this sane advice? Or rather, in a country where a lowly Major General gets more salary than the highest government bureaucrat, does the country have the political will to tackle the elephant in the room whom everyone in Pakistan wants to avoid?

Follow us at:-

Twitter Handle: @communique_news

Parler Handle: @newscommuniquecom